Your guide to

Real Estate Market

If you want to stay ahead of the game and stay informed about the ever-changing local real estate market, subscribing to our blog is a must. Our blog provides valuable insights, market trends, and expert advice from industry professionals.

The Miles River, Saint Michaels Maryland

Boating on the Miles River in St. Michaels, Maryland: A Boater's Paradisewith Real Estate Appealhttps://youtube.com/shorts/GdsempnJlws?si=vRIVkYObDNdjxg26The Miles…

Here is to the New Year!

Happy New Year to all! The start of a new year brings fresh opportunities to pursue…

Why It's Important To Work With A Realtor

When purchasing or selling a property, it is always a good idea to work with a…

Things You Shouldn't Do When Buying a Home

With a never ending list of everything you ‘should do’ when purchasing a home, it seems…

Should I Rent or Buy a Home?

Purchasing a home will inevitably be the biggest financial discussion of your life. And the decision…

10 Top Reno's That Will Up the Sale …

When getting ready to sell your home, it can be hard to know what renovations will…

Boat Ride to Dinner

https://youtube.com/shorts/oKqBwFy8Xwo?feature=shareDinner by boatNot sure what you want to do for dinner? Here on the Eastern Shore,…

Working with a realtor who lives it first …

There is so much to know about living on the water. Of course it is beautiful,…

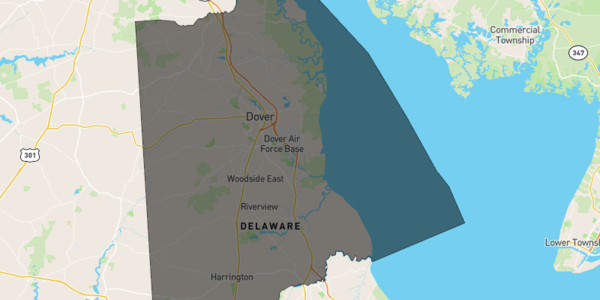

Waterfront on The Eastern Shore

The Healing Waves: How Waterfront Living Offers More Than Just a View , Waterfront on The…

Discover Blue Therapy

SELLING A FAMILY ESTATEThe estate executor contacted me, who happened to be the granddaughter. She was…

It Is An Honor

AMERICA'S TOP 100 REAL ESTATE AGENTS®October 28, 2022 – Announcing the selection of Kim Simpson among…

Stay

Connected

From real estate must-knows to local community news, get all the important updates straight to your inbox.